- Lumida Ledger

- Posts

- Lumida Ledger: The US Economy is a Melting Ice Cube

Lumida Ledger: The US Economy is a Melting Ice Cube

Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week:

Macro: Jobs Dip, Wages Up, Immigration Climbs: US Economy cool-off?

Markets: 10 year yields tumble, Tech Stumbles, Small Caps Surge - Market Hints at Hidden Gems

Company Earnings: Earnings Surprises, Sector Shifts, Utilities, Banking and more

Digital Assets: SBF, FTX, ‘No-Loser' Culture & Corporate Scandals

This week we had a great time discussing Bitcoin ETF and digital assets on the Real Vision Podcast with Jim Bianco and Ash Bennington.

We will soon host the full podcast on Lumida website for our newsletter subscribers.

Here’s the link if you have a real vision account.

This week we also had a delightful conversation with Kyle Samani from Multicoin Capital. We covered his investment philosophy, criteria for evaluating deals, managing volatility, and key crypto trends.

Kyle provided a fascinating inside look at Multicoin's investment process and his early conviction in Solana back in 2018. Tune in here.

Macro

My metaphor for the US economy has been - 'melting ice cube'.

The economy was running at 120 MPH. Now it's closer to 55 MPH and gradually slowing.

We see that both in this Friday’s Non-Farm Payrolls report and company data

First, on labor markets.

We saw 150,000 jobs created. (The number missed expectations and likely is revised down in the future.) This is the kind of pace we want to see going forward.

That's actually a normal number pre-Covid ultra stimulus.

1/3 of the jobs were Government and Healthcare. The job creation continues the trend of the US becoming more 'services' oriented

Transportation and Warehousing lost 12,000 jobs.

Those sectors represent the 'goods' economy, which is receding while Services takes more share.

Average hourly earnings rose 4.1% from a year ago, which is not too far off from YOY inflation.

Elevated wages will keep pressure on the Fed from cutting rates anytime soon.

Part of what’s keeping the labor market growing is immigration.

The rebound in immigration post-Covid is enabling employers to hire and avoid wage-price spirals. The new labor helps to grow the economic output.

Recall that GDP can be expressed as Labor supply by the Labor Productivity rate. Labor supply goes up with teenagers entering the workforce (e.g, a broadening demographic pyramid) and immigration. Productivity goes up via investment in human capital (education and training) and technology like AI.

The Foreign Born share of the labor market is around 18.5%. We haven’t seen those since 1996. And 1996 was one of the times when the Fed managed to execute a soft-landing.

At the Sector Level, Leisure and Hospitality is driving job growth.

Americans are out and about after years of lockdowns. Boomers and retirees are spending on social experiences.

That’s no surprise. We feel like we can’t find a gift to offer anyone. Everyone has everything - except maybe a Dexa scan certificate.

Now the CHIPS Act and IRA Act are set to inject further stimulus. Those programs have not come online yet.

The personal savings rate remains low.

That means Consumers are still spending. And we can see that in the same-store sales date for two large service companies: McDonald’s and Starbucks.

Notice how same store sales are increasing mid to high single digits. The rate of growth is coming down, consistent with our ‘melting ice cube’ metaphor. And the levels are higher than pre-Covid.

We don't expect a recession in the next couple of months.

Relatedly, immigration is playing a role combatting inflation and growing the economy.

Here’s a story from the WSJ called “Rebound in Immigration Comes to Economy’s Aid” about a Ukrainian diner. (I used to consume Perogis and blueberry pie there when I lived near the Bowery.)

Two years ago, Veselka, a Ukrainian diner in Manhattan’s East Village was short staffed.

They were set to curtail hours. That would limit GDP growth.

Then the war in Ukraine broke out. A program to sponsor Ukrainian refugees to live and work temporarily in the US started.

The owner, a third-generation Ukrainian American, sponsored 10 Ukrainians, mostly extended family members of his existing employees

That created 8 new, income generating jobs.

The US economy has a couple different advantages. Its ability to attract, assimilate, and integrate immigrants at all levels is one of them.

Check out the boom in Work Visas. That's helping the economy avoid a hard landing.

1 MM Work Visas. Apply any income assumption you’d like, and you can see there’s a growth impact on the economy.

Immigration is a fascinating economic lever that doesn't get enough attention.

Markets

Our very first Lumida Ledger newsletter quoted the 10-year.

That’s how big a deal the 10-year is and it is always central in our analysis.

10-year yields down to 4.52%. The 10-year went from nearly 5% to 4.52%.

That explains the rally.

This is also why I retired “Higher for Longer” a few weeks ago. Our view was that rates were experiencing a ‘blow out’ top, and that looks to be the case.

Getting macro calls right is extremely difficult. We feel good about that one - and what helped was the instinct to be ‘non-consensus’ (combined with other analysis).

The best investments this year are all non-consensus.

Here’s an excerpt called the ‘scoreboard’ from Merrill’s investment strategy desk.

Imagine you are on an investment committee.

At the start of the year, when ‘consensus’ is calling for a hard landing and a pivot, you bet on ‘higher for longer’.

In the wake of the collapse of FTX, you suggest investing in Digital Assets. You’d get laughed out of the room.

In the wake of the banking crisis, you suggest investing in JP Morgan and UBS.

In the wake of the Inflation Reduction Act, which supports EVs, you want to invest in Energy and a Nuclear Renaissance thesis and sell Tesla.

In the wake of Apple announcing Vision Pro, you decide to sell one of the best performing investments of all time.

When Grayscale discounts are widening to 50%, you decide to buy.

When ‘higher for longer’ is on the airwaves front to back, we take the opposite view.

These are all non-consensus ideas. All of them were highly unpopular, and all of them performed well.

Now, the principle of non-consensus isn’t simply to fade the Crowd. There’s more than that. There needs to be a rational underpinning or variant perception.

The key idea is (i) consensus is priced in and (ii) non-consensus views are psychologically difficult for people to bear.

People prefer the safety of crowds. Crowding leads to underperformance and performance chasing.

Why does Wealth Management Exist?

Many reasons. But one fundamental reason is psychology.

The way we develop conviction in non-consensus views is thru deep analysis and a study of market cycles. That won’t mean we get every call right, but on average, we expect to do well.

And this year our calls have been excellent. (We’ll compile an end of year thread.)

Studies show DIY investors consistently underperform the index.

Some DIY investors choose to ‘follow’ others. But, when markets get stressed, because they don’t have the internal conviction they will make a bad decision and get shaken out of a position.

Or, they may use leverage and try to ‘make it back’ and compound errors.

In a bull market, every investor thinks they are a genius. Really, they own growth factor exposures that benefit a broad basket of stocks due to multiple expansion.

2023 is a difficult market.

Good investors know that investing is difficult. It takes intense focus, skill, discipline, and risk management. It takes more than analysis - it also takes psychology.

Diversification also plays an important role because while we aim to make money on each investment, we can also wash out certain risks.

Great wealth management also links investing to tax considerations. For example, when we invest in Distressed Commercial Real Estate, our clients will get K-1s with ‘passive losses’. That’s not cashflow. That’s simply the depreciation of the asset - it’s how the tax code works.

We can use the passive losses as a ‘tax shield’ to lower our taxable income. So, we then seek a private credit fund that we expect will generate pre-tax returns of 16 to 18%. Those private credit funds will issue K-1s consisting of interest income. That’s ‘passive income’.

We can combine the Distressed CRE with the Passive Income to minimize our tax burden.

Simply put, it’s very difficult for DIY investors to execute at that level. And DIY investors don’t have access to the factor models to calibrate the weights on the holdings. They don’t have access to Direct Indexing or Tax Optimization that automates tax loss harvesting. They don’t have access to the best buy side or sell-side research.

For these reasons, and psychology, retail investors underperform. Investing a profession, and it takes a lot of skill and focus to do well.

If you really like investing, a better strategy is to work with a fiduciary wealth manager, and then setup a play account so you can scratch that itch.

Last week, we said “Statistically, there is a good chance that markets are bottoming. To the extent losses take place from here, we do expect that asset prices would recover. So, now is not the time to sell and lock-in losses. Further, if there is a significant loss from here, you should orient yourself to the idea of going ‘overweight’ after such a capitulation.”

Last week we saw some of the most positive seasonality for the entire year. (Note: positive seasonality clusters around holidays like Thanksgiving, Christmas, Halloween, New Years. Market psychology is real.)

The 10-year is a lot lower, so that helps markets.

Apple released earnings. That was a dud. Apple delivered 0.5% YOY earnings growth. Apple is one of the most widely held stocks in the world. There are 125 companies that have greater than 25% earnings growth.

Stock prices follow earnings growth in the long-run. We seek to find great businesses, with a moat, earnings growth, at a decent price. That’s the key to investing.

The more people talk about macro, the less macro matters. Focus on identifying great assets and building a quality diversified tax-efficient portfolio.

We remain of the view that markets will rally thru year-end.

That said, we never saw the capitulation in tech. And some of our sentiment indicators show investors went from depressed to ecstatic too quickly. So it won’t be a straight line.

Here are some statistics to add perspective:

2023 will be just the 9th year since 1928 that the S&P fell in each of August, September, and October.

1990 and 2016 were the last two times it happened.

November 1990 saw a gain of 5.99%. November 2016 saw a gain of 3.42%. Here's a list of the eight prior years:

Note that when markets have the kind of thrust we saw last week, that’s evidence looking one year out that market returns will be positive. That doesn’t mean we don’t get a near-term pullback.

Also, remember how China had a snap-back rally the week before? That was a preview for what happened in American markets.

Often, you’ll see this phenomenon of ‘emerging markets’ bottoming before mature markets. Emerging markets benefit from changes in liquidity and sentiment faster.

We said previously crypto would bottom in this correction before equities, and that’s exactly what has happened.

There is still a lot of liquidity out there. There’s money looking to swoop in and buy risk assets. Those buyers want good prices however. But when markets start going up, they stumble over each other to get in. And then short covering takes place, which accelerates the upward move.

That dynamic explains what we saw last week. It also gives us another datapoint to be constructive on markets.

There’s a lot of bad news already priced in, and companies are growing earnings.

Here’s the study on market breadth I shared. This is the outcome of when the 5-day average of S&P 500 components cross back above their 50 day moving average.

These ‘technical buy setups’ are not a sure thing, but it’s a good sign post.

We see several of these - including in small caps. Now may be a good time to acquire small cap stocks that are gaining market share, have positive relative strength, and do not rely on debt financing.

This is the 24th time the Russell 2000 closed at a 52-week low, then surged to its best 4-day rally in at least 3 months.

A year later, the small-cap index was higher 100% of the time with a median return of +25.6%.

The Basic Materials sector is below its 10- and 50-day moving averages.

This is a near-washout level of selling pressure that has triggered only a handful of times in 70 years.

Investing is about buying low and selling high. Overweighting the best names in Basic Materials is a great idea now.

Last week, we bought Consumer Staples. Outside of technology, where you need to be discriminating and precise, there are good bargains.

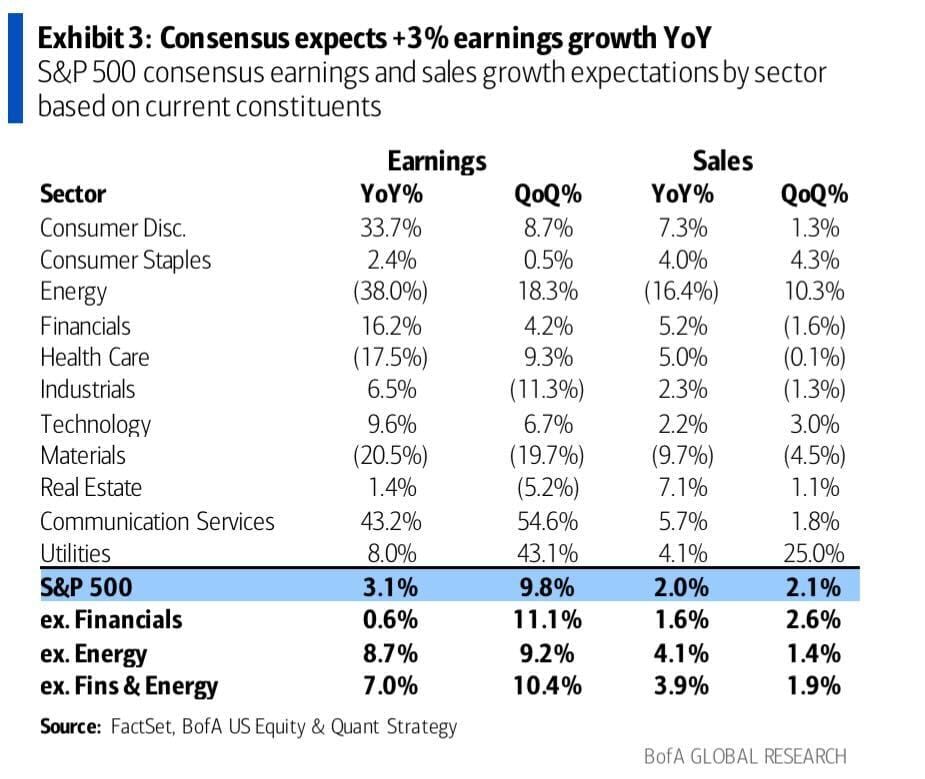

Company Earnings Summary

We wrote this summary about how earnings are shaping up earlier in the week. It’s dated a few days, but the takeaways are relevant.

64% of the S&P 500 has reported.

Here are the trends…

Good news:

- Earnings have a 7% beat over consensus

- Revenue has a 1% beat

- Orders rising, inventories falling

Neutral:

- CapEx up 1% YOY (vs 9% last Qtr)

- Down to deceleration of Capex from Meta and Amazon. (CapEx is up 7% if you exclude Meta and Amazon)

- Fiscal stimulus is coming from IR and Chips Act

- Rewards for beats dropped to 100 bps from 150 bps

> Sign of crowded positioning

Bad news:

- Beat driven by mega-cap cost cuts, rather than top-line growth

- Real (inflation adj) sales growth is negative 2.5%

- ‘Weak demand’ mentions jumped

- Margins improved via cash hoarding (corporate sentiment is down)

- Buybacks under pressure due to higher financing costs

- Margin outlook looks too rosy in tech

> The Earnings yield is less than the IG debt bond yield… higher real rates changes everything

Outlook:

- Q4 EPS cut 2% thus far due to weak guidance (nervous corporates)

Sector View:

- Consumers shifting from Discretionary spending to Staples

- Utilities showing the strongest sales and earnings growth

> Utilities also capitulated recently, looks like a good overweight now

Stock Picks

Someone asked us on X, what’s the most undervalued asset in the world right now? This is a partial list.

This excludes ‘growth stocks’ and is not meant to be complete or exhaustive. It also doesn’t include themes like nuclear renaissance.

1) Human capital

2) In Mag 7: Google

3) In Energy: Tidewater & Petrobras

4) In semiconductors: Broadcom, GFS, and ASML

5) In banks: UBS and Citi

6) In small caps: Veeco

7) In Consumer Staples: Albertson’s

Hedge Funds Pile Into Uranium Stocks

This is another non-consensus theme that has been an outstanding performer.

Here’s a snapshot of our Nuclear Renaissance model portfolio. I’d rather own this secular trend than low-growth names like Apple and Tesla.

We have an earlier Lumida Ledger which details our Nuclear Renaissance thesis.

Citibank

We mentioned in September Citibank is starting to look attractive since CEO Jane Fraser has board pressure to cut expenses and optimize capital.

Citi capitulated last week.

The stock re-tested a multi-year low and then bounced hard.

That dynamic is what we are seeing across markets. If you are not a professional investor, it’s hard if not impossible to catch those moves.

JP Morgan Gets on Board the Banks & Energy Trade

JP Morgan equity strategy: ‘Banks have been the best sector in the past 6 months, second only to Energy’

No kidding. Readers will know we are overweight in those sectors. JPM missed that call. And now their latest reasoning paints too broad a brush on an entire category.

Some banks are in a world of hurt. Others will do just fine due to minimal exposure to CRE or unsecured consumer risk.

This is the flaw with classic ‘equity strategy’. They generalize a sector and don’t look for the nuances and value underneath the hood.

Digital Assets

We’ll do a deep dive on crypto in the coming weeks.

Summary statement here is (1) Altcoin season is back - focus on quality names, and (2) the GBTC and ETHE trades are getting old. There are better moves now.

Reach out if you’d like to learn more.

Justin and Ram had a Lumida ‘What’s On Your Mind’ with two journalists that had direct access to SBF. It was a cathartic and entertaining interview. Give it a listen.

Here’s an essay reflecting on the Zeitgeist that has produced SBF.

Let Your Kids Fail

SBF is fully accountable for his actions.

SBF is also a product of a generation of parents that have raised kids by removing any obstacle to success from their path.

SBF never experienced adversity in life.

Take video games today.

They don’t have scores.

There is no goal. No one is a loser.

There is no concept of winning.

SAT Scores and standardized tests are going away, because they hurt feelings.

We understand that performance matters in Athletics.

But we do not allow competition in Academics and tolerate mediocrity professionally because of ‘feelings’

There is a desire to protect kids from ‘bad feelings’.

Bad feelings are bad and should be avoided.

Parents have removed the roadblocks and adversity in kids lives.

Parents are doing kids homework in high school.

Ex-Admissions officers write college application essays that are designed to key into diversity rather than meritocracy.

Parents continue to write essays for their kids in College.

Then Parents line up the Internship at the fancy Wall Street Bank.

Life is perfectly smooth.

Life is playing bowling with the bumpers on.

These kids grow up with a false sense of competence and esteem.

Adversity and suffering teaches humility

SBF and Elizabeth Holmes are product of the ‘bad feelings generation’.

When they are told they can’t fail and are unique snowflakes, they act entitled.

Entitled to do what?

Entitled to do whatever they want.

Including fraud. That’s how their video game is wired.

The best flowers are those that struggle to break through the concrete and blossom.

Their roots grow strong.

Treat your kids the same way.

Let them stumble and fall. Hold them in their suffering. Don’t walk the path for them.

You will be teaching them lessons of personal accountability, humility, and self-cultivation.

Let your kids fail.

Work with us: we are are looking for a client associate to help us with sales and client service support. Send referrals here.

Meme of the Week

Quote of the Week

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

Benjamin Graham

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

Join our waitlist here if you’re interested in learning more about Lumida’s wealth management.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.